Looking for tips and guidance on Blue Guardian challenges? This expert guide will help you get started.

What are Blue Guardian challenges?

The prop firm is popular for its generous evaluation rules and unlimited trading period. But is this is the best prop challenge for you? Or should you go with a different forex funded account?

There are a ton of forex prop firms operating in the market right now.

However, Blue Guardian stands out amongst them because of its unique challenges. In this guide below, you’ll learn about the rules of Blue Guardian challenges as well as the various conditions associated with them.

Let’s get started.

Blue Guardian provides traders with a selection of three funding program accounts to pick from:

| $200,000 Balance | Phase 1 | Phase 2 | Guardian Trader |

| Trading Period | Unlimited | Unlimited | Indefinite |

| Minimum Trading Days | 0-days | 0-days | – |

| Profit Targets | $16,000(8%) | $8,000(4%) | – |

| Maximum Loss | $16,000(8%) | $16,000(8%) | $16,000(8%) |

| Maximum Daily Loss | $8,000(4%) | $8,000(4%) | $8,000(4%) |

| Account Leverage | 1:100 Maximum Leverage | 1:100 Maximum Leverage | 1:100 Maximum Leverage |

| Profit Split | 85% | 85% | 85% |

| Refundable Fee | $947 | Free | Refund |

The objective of Blue Guardian’s limitless guardian assessment program account is to find skilled and dedicated traders who are rewarded for their consistent performance during the two-phase evaluation period. The basic guardian evaluation program account enables trading with a leverage ratio of 1:100.

| Account Size | Price |

| $10,000 | $87 |

| $25,000 | $187 |

| $50,000 | $297 |

| $100,000 | $497 |

| $200,000 | $947 |

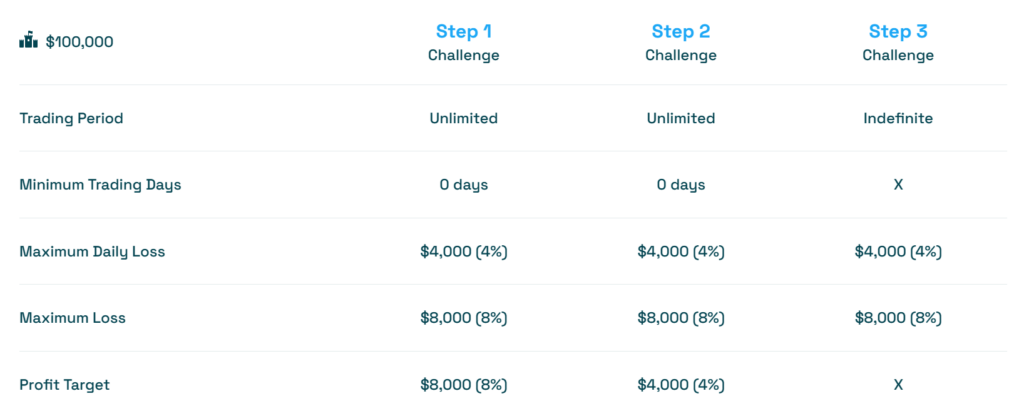

The first phase of the evaluation requires meeting an 8% profit objective while following the 4% limit on daily losses and the 8% limit on overall losses. There are no specific restrictions for the minimum or maximum number of trading days. To advance to phase two, one must achieve the identical 8% profit objective while adhering to the prescribed constraints on losses.

During the succeeding phase two review, traders strive to achieve a profit target of 4%, while adhering to the regulations of a maximum daily loss of 4% and a maximum overall loss of 8%. Additionally, there are no limitations on the number of trading days. To transition to a funded state, it is essential to meet the 4% profit target while staying under the prescribed maximum daily and maximum loss restrictions.

After completing all assessment rounds, traders are rewarded with a funded account that does not have any profit targets. The only condition is that they must follow the regulations of a maximum daily loss of 4% and a maximum loss of 8%. The first payout is made 14 days after opening the funded account, with a profit split of 85% based on the earned profit.

Guardian evaluation program accounts with unlimited access also have a scalability strategy. Traders must achieve a profit goal of at least 12% within a three-month timeframe, with two out of the three months being profitable. They will be granted a 30% increase in the account balance.

After 3 months, if the trader possesses an account with a balance of $200,000, the balance on the account will experience an increment and reach a total of $260,000.

Within the next three months, the balance of $260,000 will rise to $320,000.

Following the next three months, the balance of $320,000 will rise to $380,000.

Furthermore, the trading instruments available for the limitless guardian assessment program accounts include currency pairings, commodities, indices, and cryptocurrencies.

The fundamental principles of trading prerequisites and the accompanying hazards.

| $200,000 Balance | Phase 1 | Phase 2 | Guardian Trader |

| Trading Period | Unlimited | Unlimited | Indefinite |

| Minimum Trading Days | 5-days | 5-days | – |

| Profit Targets | $16,000(8%) | $8,000(4%) | – |

| Maximum Loss | $20,000(10%) | $20,000(10%) | $20,000(10%) |

| Maximum Daily Loss | $8,000(4%) | $8,000(4%) | $8,000(4%) |

| Account Leverage | 1:50 Maximum Leverage | 1:50 Maximum Leverage | 1:50 Maximum Leverage |

| Profit Split | 85% | 85% | 85% |

| Refundable Fee | $1090 | Free | Refund |

Blue Guardian’s Elite Guardian Evaluation Program seeks to recognize skilled and disciplined traders, rewarding them for their consistent performance across a comprehensive two-phase evaluation period. Additionally, the Unlimited Guardian Evaluation Program account offers traders the opportunity to engage with 1:50 leverage.

| Account Size | Price |

| $10,000 | $120 |

| $25,000 | $240 |

| $50,000 | $370 |

| $100,000 | $570 |

| $200,000 | $1,090 |

To move to the next phase of evaluation for trading, the trader must meet certain criteria. During phase one, they need to make a profit of 8%, while not exceeding their maximum daily loss of 4% or maximum loss of 10%. Traders are not limited by the number of trading days, but they must trade for at least five days to proceed to phase two.

In phase two, they must reach a profit target of 4%, while not exceeding their maximum daily loss of 4% or maximum loss of 10%. Again, there is no maximum limit on the number of trading days, but they must trade for at least five days to move to the funded account. Once they complete both evaluation phases, they will be awarded a funded account with no profit targets.

They will only be required to follow the maximum daily loss of 4% and maximum loss of 10% rules. Their first payout will be 14 calendar days after they place their first position on the funded account. The profit split will be 85%, based on the profit they make on the funded account.

| $200,000 Balance | Phase 1 | Guardian Trader |

| Trading Period | Unlimited | Indefinite |

| Minimum Trading Days | 0-days | – |

| Profit Targets | $20,000(10%) | – |

| Maximum Loss | $12,000(6%) | $6,000(6%) |

| Maximum Daily Loss | $8,000(4%) | $8,000(4%) |

| Account Leverage | 1:100 Maximum Leverage | 1:100 Maximum Leverage |

| Profit Split | 85% | 85% |

| Refundable Fee | $947 | Refund |

Blue Guardian’s Rapid Guardian Evaluation Program identifies experienced and disciplined traders who are rewarded for their consistency during the one-phase evaluation period. The Rapid Guardian Evaluation Program allows traders to trade with 1:100 leverage.

| Account Size | Price |

| $10,000 | $97 |

| $25,000 | $197 |

| $50,000 | $297 |

| $100,000 | $497 |

| $200,000 | $947 |

During the assessment period, traders are required to meet a profit target of 10% while following the regulations of a maximum daily loss of 4% and a maximum trailing loss of 6%. There are no specific conditions for the minimum or maximum number of trading days. The only need for moving to a funded account is achieving the profit target successfully.

After finishing the evaluation process, traders are given a funded account that does not have any profit goals. However, they are required to follow the rules of a maximum daily loss of 4% and a maximum trailing loss of 6%.

The first payout is made 14 calendar days after the first position is initiated on the funded account. Following that, payouts are scheduled every two weeks from the date of the first payout. Traders are entitled to an 85% profit division, which is determined by the profits generated in their funded account.

Choosing the right challenge from a prop firm like Blue Guardian involves a thorough evaluation of your own trading style, experience, and risk tolerance. Each challenge may have different rules, targets, and restrictions that could either complement or hinder your trading strategy. Here are steps and considerations to help you determine which Blue Guardian challenge is best suited for you:

Selecting the right challenge from Blue Guardian involves a careful assessment of your trading approach, risk tolerance, and the specific requirements and rewards of each challenge. By aligning these factors, you can increase your likelihood of success and find a challenge that not only tests your skills but also offers a pathway to grow as a trader with the firm’s backing.

Blue Guardian is a proprietary trading firm that has garnered attention in the professional trading community for its unique approach and offerings to traders around the globe. As a prop firm, Blue Guardian provides traders with the capital to trade in various financial markets, including Forex, commodities, and indices, under its proprietary trading model. This model allows traders to leverage Blue Guardian’s capital in exchange for a share of the profits generated from trading activities.

The CEO of Blue Guardian is Sean Banton, a highly experienced and sophisticated trader.

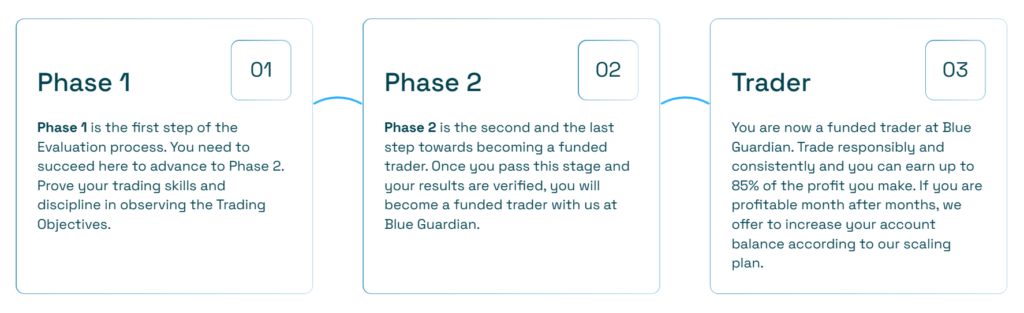

One of the standout features of Blue Guardian is its structured evaluation process, designed to identify and onboard skilled traders. Candidates are typically required to pass a trading evaluation challenge, where their trading strategy, risk management, and profitability are assessed over a set period. This evaluation ensures that only traders who demonstrate a solid understanding of market dynamics and a disciplined approach to risk are entrusted with the firm’s capital.

Blue Guardian offers a variety of account sizes and profit-sharing models, catering to both novice and experienced traders. The firm places a strong emphasis on risk management, providing traders with guidelines and tools to manage trades effectively and minimize losses. This focus on risk management is crucial in the volatile world of trading, where preserving capital is just as important as generating returns.

The firm also invests in technology and support, providing traders with access to top-tier trading platforms, real-time data, and analytics tools. This technological infrastructure enables traders to execute trades efficiently and make informed decisions based on market analysis.

Professional development and community are other pillars of Blue Guardian’s philosophy. The firm encourages continuous learning and improvement through educational resources, webinars, and a community of traders. This environment fosters collaboration and exchange of ideas, which can be invaluable for traders looking to refine their strategies and adapt to changing market conditions.

In summary, Blue Guardian stands out in the proprietary trading space for its rigorous trader evaluation process, commitment to risk management, and investment in technology and trader development. These aspects, combined with the opportunity to trade with significant capital, make Blue Guardian an attractive option for skilled traders seeking to maximize their trading potential. As with any trading endeavor, success with a prop firm like Blue Guardian requires discipline, a deep understanding of the markets, and a commitment to continuous learning and improvement.

What are your thoughts on these Blue Guardian challenges? Do you think they are easy to pass? Or are the conditions excessively difficult?

Share your thoughts in the comments section below.

We’d love to hear from you.

Alternatively, you can read the full Blue Guardian review.

Best Of

Best Forex Prop Firms 2024

Cheapest Forex Prop Firms 2024

Best Forex Brokers 2024

Compare

Fidelcrest Vs The5ers

The Funded Trader Vs The5ers

Goat Funded Trader Vs Glow Node

Warnings

Forex Prop Scams

Forex Prop Warnings

Worst Forex Prop Firms 2024

Who Are We

About Us

Contact Us

Advertise With Us

How We Test

ForexTelevision.com is a website that provides resources and information related to forex trading. It focuses on proprietary trading firms (prop firms) and offers content on various aspects of forex trading, including how to use trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), how to open a prop trading account, and how to develop a trading plan.